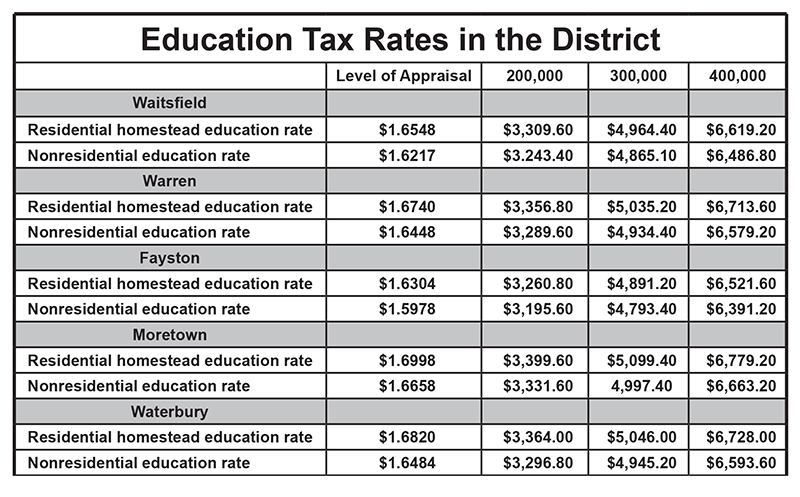

As a follow up to last week’s chart showing municipal tax rates throughout The Valley, this week, The Valley Reporter has created a chart showing the education tax rates in the Harwood Unified Union School District (HUUSD).

Per Vermont’s education funding formula, district education tax rates are set by Montpelier and are based on district per pupil spending and enrollments. Vermont’s education funding formula sets different rates for homestead or residential property and nonresident property. When this split was created it was to have created lower education tax rates for residential parcels and higher for nonresidential parcels. This has never been the case in The Valley where nonresidential rates are consistently and significantly lower than residential rates.

Since the six towns in the HUUSD voted to merge school boards under Act 46 in 2016, education taxes should be equal throughout the district – and they are close, but not equal. The differences are due to each town’s Common Level of Appraisal (CLA), a metric the state uses to assess whether towns have property appraised at 100 percent of fair market value.