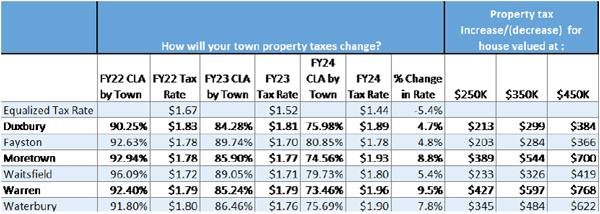

Vermont towns’ educational spending is determined by the annual common level of appraisal, or CLA, determined by the Vermont Department of Taxes. According to the department, the CLA “is a method of ensuring that each town is paying its fair share of education property tax to the state’s Education Fund.”

Below is a chart provided by Harwood Unified Union School District (HUUSD) director of finance and operations Lisa Estler, that shows CLA for FY2024 in the district as compared to the last few years. The chart shows the CLAs of each local town and the projected tax rates that will result from this year’s budget. Estler presented a draft FY2024 budget at the HUUSD January 11 meeting in the amount of $45,311,614, a 6.23% increase over the FY2023 budget.

“The majority of the increases is due to increasing “Other” by allocating the total FY22 carry forward of $696,931 rather than the initial allocation of $350K. Purchased services/Property increase over FY23 due to increase building operations. Other purchased services include increased costs for special educational, transportation and increase insurance costs. Supplies include increase building and operation supplies, heating oil, wood chips, electric and propane cost,” Estler said in a memo.

Chart provided by the HUUSD

The Vermont Department of Taxes’ website says, “The equalization study (which determines the CLA) compares the ratio of the grand list listed value to the sale price for all the arm’s length sales in the town over the prior three-year period. The study considers sale price as the best measurement of fair market value. If grand list values are generally less than sale prices for the recent sales, the town will end up with a CLA less than 100%. If grand list values are generally more than sale prices for the recent sales, the town will end up with a CLA of more than 100%. Once the CLA is determined, it is used to adjust the homestead and non-homestead education tax rates. The CLA doesn’t change taxpayer’s property values, only the education tax rate in a town -- an example of indirect equalization.”

BOARD SEATS AVAILABLE

Also discussed at the January 11 HUUSD Board meeting was the fact that there are several seats on the school board which will be up for election on Town Meeting Day in March. Moretown and Waitsfield will each have one open seat, while Fayston, Duxbury and Waterbury will each have two seats up for election. The deadline to submit a petition to run for the HUUSD Board to the local town clerk is January 30, 2023. More information can be found at huusd.org.