Over the past few months, the Mad River Valley Planning District (MRVPD) and the Mad River Valley Chamber of Commerce have collected a lot of ideas about economic vitality from community members. Now, they are looking into a local option tax (LOT) to collect money to help make those ideas a reality.

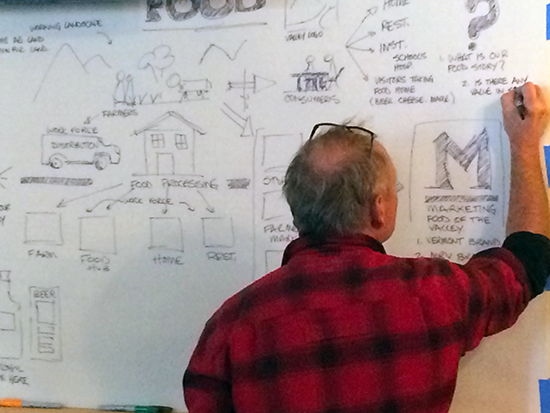

This summer and fall, the MRVPD and the Mad River Chamber of Commerce hosted a series of Economic Vitality workshops to help plan for future growth in The Valley. At those workshops, community members engaged in passionate dialogue. They talked about the need for more affordable housing for full-time residents as well as the need for The Valley to come up with a more cohesive marketing message to attract second-home owners to the area, but doing more than talking requires funding.

The planning district does not have the time or resources to follow up on all of the information that came out of the Economic Vitality workshops, MRVPD Steering Committee chair Bob Ackland told sector representatives who came together at the Hyde Away Inn and Tavern last Monday, October 19, explaining that the planning district has already utilized about 1,700 non-staff hours in hosting the series.

To supplement the MRVPD’s budget, which is currently funded by its three member towns of Waitsfield, Warren and Fayston, The Valley could implement a local option tax, Ackland said.

A local option tax is a way for municipalities in Vermont to raise additional revenue. Residents can vote to levy the 1 percent tax on sales, meals, alcoholic beverages and/or rooms, in addition to state business taxes.

Of the revenue from the 1 percent tax, Ackland explained last Monday, 70 percent would stay in the municipalities and 30 percent would go to the state. If implemented in The Valley, the planning district estimates a local option tax could generate about $700,000 in annual revenue for the region.

“We’ve had the conversation and we’ve done enough digging to know what the mechanics would be,” Ackland said, explaining that the local option tax could be voted on by residents in November of 2016.

At Town Meeting this past March, voters in Colchester approved a local option tax, joining its neighbors of Williston and Burlington, who had already implemented the tax, and the resort communities of Killington and Stowe.

Unlike The Valley, “every other ski town in Vermont already has it,” Ackland said of the local option tax and the Economic Summit scheduled for December 17 “is our opportunity to sell it,” he said.