Four of five Valley towns have set their tax rates and The Valley Reporter reached out for the details on how the municipal tax rates will affect tax bills when they come out in a few weeks.

Warren, Waitsfield, Fayston and Moretown have set their tax rates. Duxbury will be setting its rate in the coming weeks once its Grand List details are finalized.

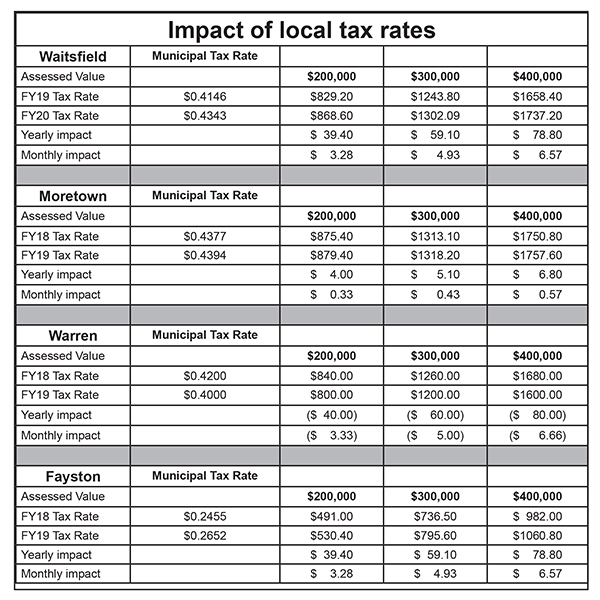

In the chart below, Waitsfield’s tax rate is listed for 2019 and 2020 while the other towns’ rates are listed for 2018 and 2019. That is because Waitsfield uses a fiscal year that runs from July 1 through June 30 while the other towns use a January through December calendar. Duxbury and Waitsfield use the same method.

The tax rates listed below are only for the municipal portion of property tax. They do not include education tax rates, which are determined by the state based on district per pupil spending and each town’s common level of appraisal.