Tax rates for the new fiscal year are in. Below is The Valley Reporter’s tax rate roundup that compares new tax rates to old in six different towns. Note that Waitsfield and Duxbury’s tax rates are listed for 2020 and 2021, while other town’s tax rates are listed for 2019 and 2020. This is because Waitsfield and Duxbury use a fiscal calendar that runs from July 1 through June 30, while other towns use a January through December calendar. Municipal as well as resident and nonresident education tax rates are listed below. All tax rates listed are per $100 of assessed value.

WAITSFIELD

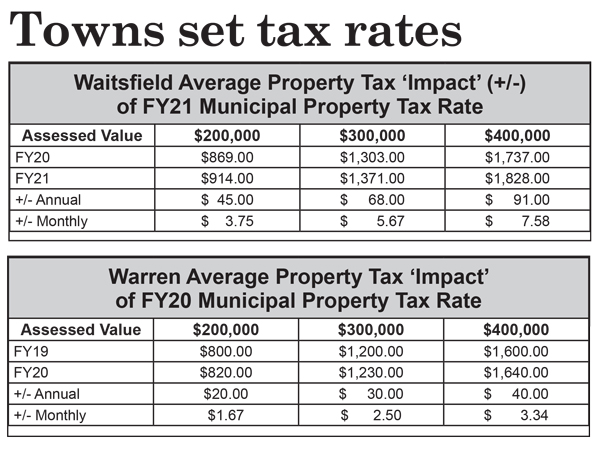

Waitsfield has set its tax rate for fiscal year 2021which runs from July 1, 2020, to June 30, 2021. This year the municipal tax rate is up 5.3% from $0.4308 in FY2020 to $0.4535. The FY 2019 municipal tax rate was $0.4112. Waitsfield also has a local agreement, which adds a fraction to the municipal tax rate. In FY20 that was $0.0035. It remains the same for FY21. Total tax bills reflect education tax bills based on homestead and nonresidential rates. Property tax rates throughout the Washington West Supervisory Union are relatively uniform due to district towns merging under Act 46 in 2016. Variances from town to town reflect each town’s Common Level of Appraisal, a metric that the state uses to balance where each town’s appraisal rates intersect with fair market values based on real estate sales.

Education tax rates for homestead residents in Waitsfield for FY 2020 were $1.6548. That will drop to $1.6509 for FY21. Nonresidential rates for FY20 were $1.6217 which will increase to $1.6458 for FY21. Total property tax bills, including municipal taxes, local agreement and education taxes for Waitsfield property owners who are homesteaders will be $2.1079 in FY21 compared to $2.0891 in FY20. Total nonresidential tax rates will be $2.1028 in FY21, up from $2.0560 in FY20.

FAYSTON

Fayston’s tax year runs from January 1 to December 30 so the rates it released last month were for 2020. This year’s town tax rate is $0.2816 per $100 of assessed value, compared to the 2019 rate of $0.265. The residential education tax rate for 2020 is $1.681, compared to last year’s $1.6304. The nonresidential education tax rate for 2020 is $1.6578 compared to last year’s $1.5978. It is worth noting that Act 66, a bill that updated the state’s Act 60 education funding formula, was supposed to create a two-tiered education funding tax system that resulted in second-home owners paying more than residents for education, but that has not played out in Fayston and other Mad River Valley towns.

MORETOWN

In Moretown, the new municipal tax rate is $0.5, per $100 of assessed value, about 6 cents higher than the previous year’s municipal tax rate of $0.4394. The resident homestead education tax rate in Moretown for this year is $2.2214, about 6 cents higher than the previous year’s resident homestead education tax rate of $2.1392. The nonresident tax rate for Moretown this year is $2.216, up about 4 cents from last year’s nonresident tax rate of $2.1052.

WARREN

In Warren, the new municipal tax rate is $0.41, 1 cent higher than the previous year’s municipal tax rate of $0.4. The resident homestead education tax rate this year is $1.6814, less than a cent higher than last year’s resident homestead education tax rate of $1.6784. The nonresident education tax rate for Warren this year is $1.6761, about 3 cents higher than last year’s nonresident education tax rate of $1.6448.

DUXBURY

In Duxbury, the new municipal tax rate is $0.7972, about 22 cents higher than the previous year’s municipal tax rate of $0.5735. Duxbury’s resident homestead education rate is $1.7623, about 6 cents higher than the $1.6998 homestead education rate of last year. The nonresident education rate this year is $1.7568 for Duxbury, nearly 11 cents higher than last year’s $1.6481 rate.

WATERBURY

In Waterbury, the municipal tax rate this year is $0.51, level with last year’s municipal tax rate of $0.51. The resident homestead education tax rate for this year is $1.7368, nearly 6 cents higher than last year’s resident homestead education tax rate of $1.6820. Waterbury’s nonresident education tax rate this year is $1.7314, about 8 cents higher than last year’s rate of $1.6484.

Waterbury town manager Bill Shepeluk explained that while Waterbury expected to raise the municipal tax rate to $0.55 cents, spending cuts were made to keep the tax rate level with the previous year. “In the aggregate Waterbury taxpayers saved $305,000 due to this reduced rate. Taxpayers with property valued at $300,000 saved $120,” said Shepeluck.